Global Market Review

- MAC10

- Feb 19, 2024

- 1 min read

With the U.S. closed, let's take a look at what's going on around the world.

First, the European Composite (weekly) hedged in Euro terms: Rising wedge, with a recent pullback to the mid-point followed by parabolic burst above upper trendline.

Bullish until you get trapped outside the trendline.

Emerging Markets (weekly). Fourth lower high.

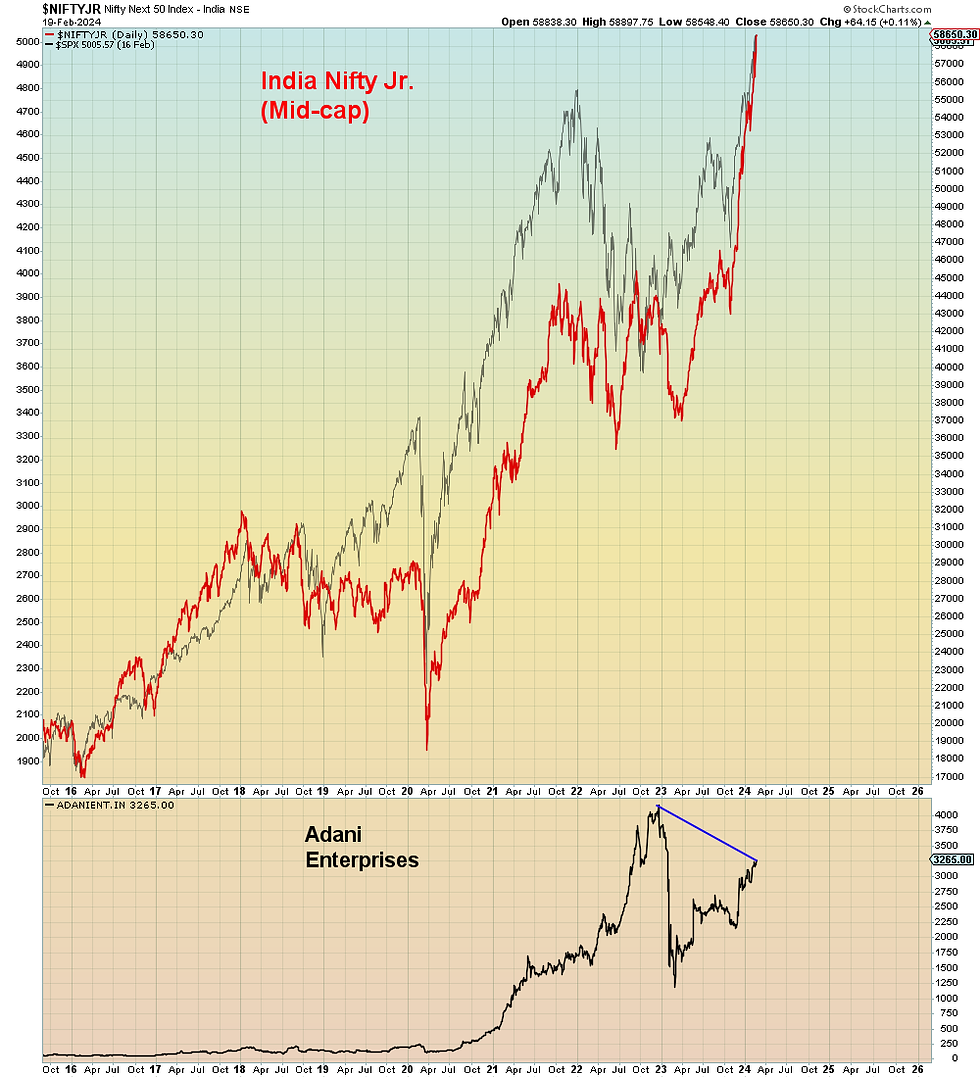

The winner is, India. Global investors have been rotating out of China to buy parabolic Indian stocks.

Unfortunately, it's only a matter of time before Adani collapse reminds everyone that it's merely a Ponzi market.

China just returned from Lunar (Spring) festival and now the currency is re-imploding due to the strong dollar amid reduced Fed rate cut expectations. Notice that the currency gets ignored until it reaches the bottom of the range and then U.S. investors discover China on the map again.

The Canadian Dow and the S&P 500 equal weight are essentially the same chart. What they confirm is that for the economically sensitive sectors i.e. ex-Tech, this is merely a three wave correction of a bear market. It's not a new all time high.

Last but not least, Japan is partying like it's 1989.

Why? Hendry's Law: The worse the reality of the economy, the more investors front-run aggressive monetary policy. Until it all explodes and no one questions why stocks were rallying in a recession.