top of page

Category Posts

Morning Market Report Jan. 26th, 2024

The Fed's preferred measure of inflation - Core PCE - came in as expected. The market opened flat on the news. After hours last night...

Jan 26, 20241 min read

Closing Market Report: Jan. 25th, 2024

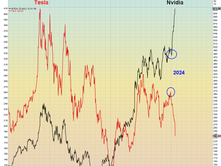

Another day of epic divergences. This time, the divergence is between the two highest dollar volume stocks on the Nasdaq - Nvidia v.s....

Jan 25, 20242 min read

Morning Market Report: Jan. 25th, 2024

GDP Morning futures were bid following the "Goldilocks" GDP report showing faster growth and slowing inflation. A few pundits are...

Jan 25, 20241 min read

S&P 500 Volume Oscillator

The S&P 500 intermediate term volume oscillator. Updated as of January 24th, 2024: Stockcharts Link: https://schrts.co/KPqqpRnf

Jan 24, 20241 min read

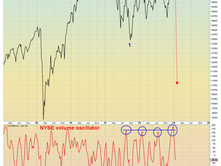

NYSE intermediate term volume oscillator

Stockcharts Link: https://schrts.co/hwFfVpYk Chart updated: Jan. 24th, 2024

Jan 24, 20241 min read

Nasdaq Intermediate Term Volume Oscillator

Chart updated: January 24th, 2024

Jan 24, 20241 min read

Closing Market Report: Jan. 24th, 2024

The "Market" eked out another gain today, however breadth on both exchanges ended firmly negative. Tesla earnings are out after hours:...

Jan 24, 20241 min read

Late Stage Parabolic Tech Bubble

What we are watching in real-time is another generation of young investors (and many old, who should know better) about to get wiped out...

Jan 24, 20242 min read

Morning Market Review: Jan. 24th, 2024

Headline of the day: "Investors are chasing the strong returns. They poured about $4 billion into tech funds over the two weeks that...

Jan 24, 20241 min read

Closing Market Review: Jan. 23rd, 2024

As of yesterday's close the Nasdaq had its third confirmed Hindenburg Omen - the most since November 2021. Last night I created a...

Jan 23, 20241 min read

Morning Market Review: Jan. 23rd, 2024

Overnight, the BOJ pleased the bulls by keeping short-term rates unchanged. For now, the spigot remains wide open. Which begs the...

Jan 23, 20241 min read

Market Review: January 22nd, 2024

Two Hindenburg Omens on the Nasdaq so far in 2024 and possibly another one today. The Hindenburg Omen is triggered when there are large...

Jan 22, 20241 min read

bottom of page